Africa’s long-term travel prospects hinge on its domestic demand, a trend accelerated by the pandemic and an opportunity for the continent’s tourism-rich countries.

“Africa for Africa is vital,” said Anita Mendiratta, special advisor to the UNWTO Secretary General, who spoke to Skift at the Airbnb Africa Summit in Johannesburg.

“Domestic tourism was always the poor cousin of tourism. If you couldn’t afford to travel overseas, you stayed at home. Now, the value of domestic tourism has remained,” Mendiratta said.

Africa for Africa’ might sound cliche, but industry stakeholders think its potential as a tourism strategy has yet to be fully tapped. – Selene Brophy

Africa’s long-term travel prospects hinge on its domestic demand, a trend accelerated by the pandemic and an opportunity for the continent’s tourism-rich countries.

“Africa for Africa is vital,” said Anita Mendiratta, special advisor to the UNWTO Secretary General, who spoke to Skift at the Airbnb Africa Summit in Johannesburg.

“Domestic tourism was always the poor cousin of tourism. If you couldn’t afford to travel overseas, you stayed at home. Now, the value of domestic tourism has remained,” Mendiratta said.

For example, domestic tourism in South Africa climbed by 31% in overnight trips during the first four months of 2023 from a year earlier. Domestic travel spending during this periodrose by 41%, according to South Africa’s Tourism Department data.

An Airbnb Economic Impact study detailing bookings for 2022 showed domestic stays in the country had increased by 34%, with seven of the 10 fastest-growing places visited outside of South Africa’s main tourist areas in the Western Cape and Gauteng.

While the World Travel & Tourism Council forecast the tourism sector could contribute 7% to the continent’s GDP in the next decade, challenges remain. This is despite the recently introduced African Continental Free Trade Area, the world’s largest by participant count, anticipated to ease trade and services across the continent.

High travel costs and poor transportation networks within and between countries make planning a trip harder than in other, more developed destinations. Mendiratta called the continent’s visa issues between countries a costly barrier.

WTTC pre-pandemic data also showed that domestic tourism accounted for 55% of spending in Africa, compared to 83% in North America and 64% in Europe, pre-pandemic.

Africa’s Middle Class Could Drive Growth

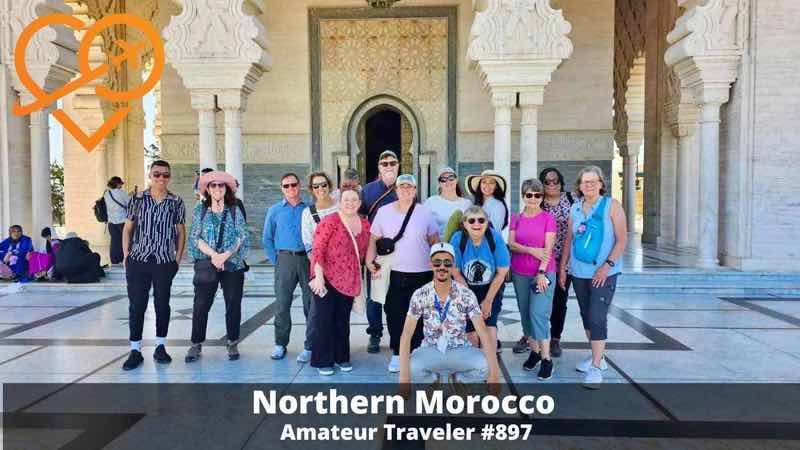

Yet, analysts suggest Africa’s expanding middle class could have domestic and regional tourism potential. The World Bank estimated a pre-pandemic middle class of 170 million people spread across the continent and its diverse economies, including Kenya, Egypt, Morocco, and Nigeria.

The African Development Bank sees one-third of the continent’s population as middle class based on a $2-20 daily spending, unlike data firm Fraym, which identified a “consumer class” of 330 million by analyzing ownership and education.

The continent has the youngest population in the world, with more than 60% of Africans under 25, which further presents a potential travel segment worth nurturing.

Purpose-Driven Travel

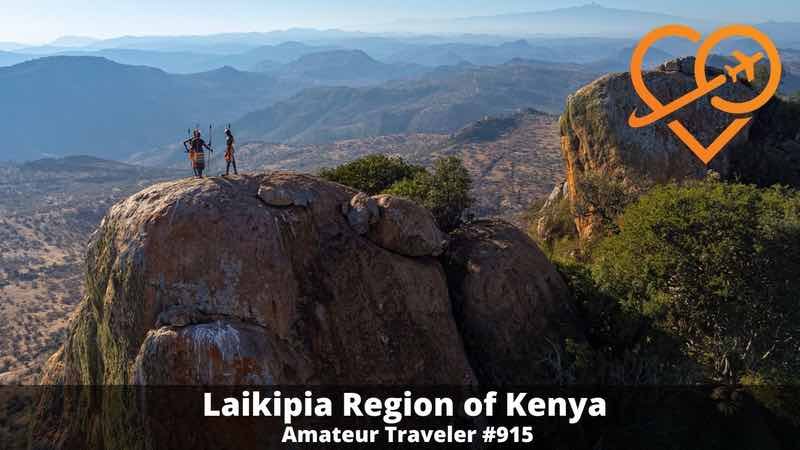

There has been a forced reevaluation of what travel experiences mean on the continent, according to Mendiratta. She added that it is rooted in purpose-driven travel, further triggered by the pandemic, as travelers seek meaningful experiences rather than self-centered journeys.

“There is nowhere in the world that, at a cultural, social, and spiritual level, delivers [more] purpose-based travel than Africa. People come here to be unlocked,” said Mendiratta. “So they go home a different person. And that’s where Africa has always been the fastest track to people’s conscience and their hearts. That, to me, is the future of travel in Africa.”